As Namibia’s pioneer development microfinance institution, Konga Microfinance, partners with local and international DFIs to provide underserved populations with access to capital. Our focus is on stimulating economic activity by supporting MSME growth, investing in renewable energy, creating jobs, and enhancing household food security, especially in rural communities.

In 2010, Konga Microfinance and the Government Institutions Pension Fund (GIPF) entered into a ten year investment agreement under GIPF’s unlisted investment portfolio, that resulted in the placement of development capital through which Konga Microfinance was able to provide its range of microfinance products, thereby making a tangible and visible contribution to the Namibian economy through the provision of inclusive and affordable productive credit to individual off-grid households to light up their homes with stand-alone solar systems and MSME enterprises, targeted mainly to communities in the rural and off-grid communities, thereby stimulating economic activity, the expansion of a renewable energy sector and the improvement of lives and livelihoods at the bottom of the socio-economic pyramid.

In 2015, Konga Microfinance and the German Savings Banks Foundation for International Co-operation entered into a five year banking technical agreement to augment Konga Microfinance’s product offering (which includes MSMEs, group microenterprise, green energy and agribusiness finance), to expand its geographic footprint by opening up additional branches in communities where such services are most needed, and to strengthen KMF’s equity position through the extension of a line of credit to Konga Microfinance to expand its geographic footprint, readying it to lay the foundation of a Namibian deposit taking microfinance institution and support its natural and strategic evolution into a fully-fledged Tier-2 deposit taking MFI.

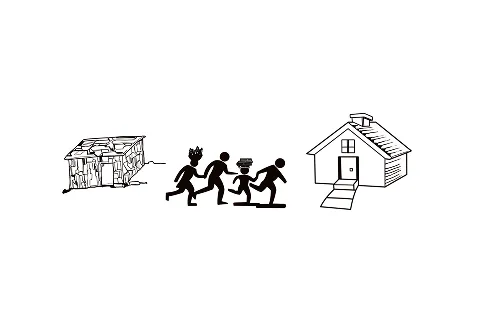

Fair Planet, a German Climate Justice Cooperative, focuses on three goals: global climate protection, sustainable development in disadvantaged regions, and environmentally friendly energy in industrialized areas. It operates projects in Germany, Kenya, Nigeria, Namibia, and the Philippines, partnering with organizations in developing countries and involving members from 13 nations. In 2022, Fair Planet partnered with Konga Microfinance to provide development credit to finance solar home systems (3–4 lights) for low-income rural women and youth in off-grid communities and informal settlements. These short-term loans target women-led households, micro-entrepreneurs, and youth in business.

The Environmental Investment Fund of Namibia (EIF), established under the Environmental Investments Fund Act of 2001, is a statutory entity focused on mobilising financial resources for environmental protection, green energy, and natural resource management. It supports climate mitigation and sustainable economic development in Namibia.

In 2023, EIF partnered with Konga Microfinance to create a green impact facility within Konga Microfinance. This initiative aims to finance climate-friendly investments in green energy, sustainable agriculture and tourism, while empowering Namibian MSMEs and smallholder farmers to diversify into biomass value chain production.

We collaborate with Institutional Partners to enhance our capabilities and drive meaningful community impact through innovative financial solutions.